The Cape.ai platform enables financial firms to leverage the power of agentic AI to increase reach, insight and efficiencies across their daily operations.

Ken Hans

Partner, Vice President, Blackstone Technology Group

The Bank has capitalized on Cape's platform to streamline client marketing campaign execution, thereby improving operational efficiency through workflow automation.

Adrian Glace

CTO, Amalgamated Bank

With Cape.ai, we have realized significant time and operational cost savings for new account openings. We were able to repurpose an entire team of analysts by leveraging Cape’s powerful AI and PDF processing capabilities in a matter of weeks. The product has far reaching potential value across the Global Holdings enterprise and our strategic Financial Services business partners.

Andrew Schmidtke

COO, Global

Platform Features

Tangible business ROI

Integrating structured and unstructured data sources, automating complex manual processes.

DOMAIN EXPERTISE

Built from real world customer use cases including financial risk, operations, compliance and audit teams.

CONTROL

Users stay in control of their data, processes and AI.

TRANSPARENCY

Fully citable outputs, complete data lineage and auditability.

ORCHESTRATION

Flexible implementation of agentic and deterministic automation.

Designed From Customer Needs,

Powered by AI

Cape is built from the ground up from real customer problems and use cases, leveraging the latest AI infrastructure available.

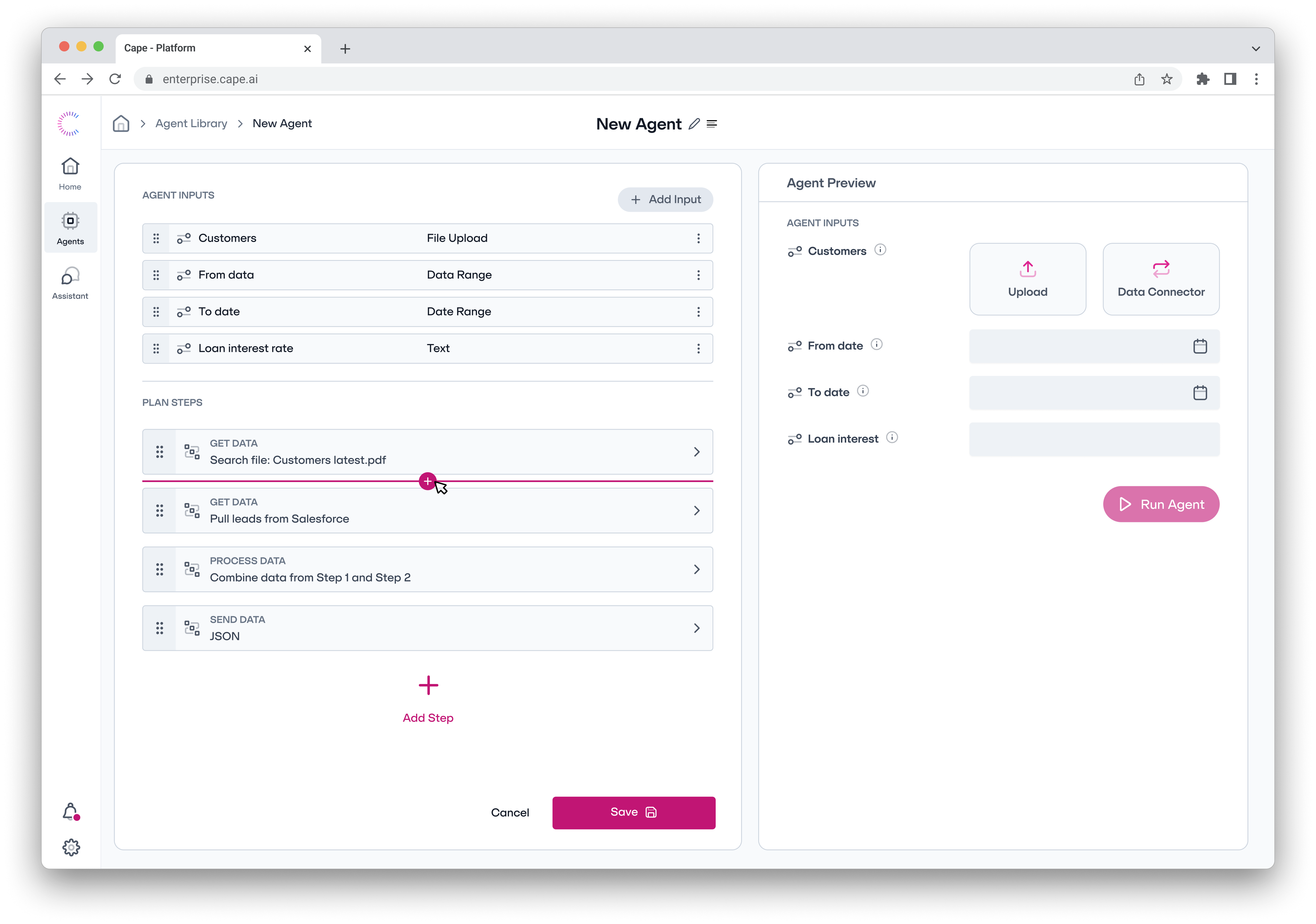

CONFIGURE

Turn your multi-step process into an agent.Explain it in natural language.

AUTOMATE

Connect Cape agents to your data.Customize agent behavior.

MANAGE

Audit steps and results.Set notifications and approvals.

Seamless Integrations for Every Financial Workflow

Cape has all of the needed out of the box data integrations/connectors to complete your most complex financial operations.

Direct Access to Leading Financial Data Providers

Cape offers integrations with Financial Services data sources.

Work Without Limits on File Types

Cape provides flexible file type/document support.

Real-World Impact

Create powerful AI agents without technical barriers, unlocking real business value with speed and confidence.

Loan Services

Cape streamlines loan applications by verifying that information matches and reaches the right person.

New Account Openings

Redeployed analysts, accelerating account openings and saving millions.

Risk Management

Cape.ai automates end-to-end SOC report analysis, reducing manual effort by 85%.

Backed by World Class Investors